cecl impact on stress testing|what is cecl : distributors 0.8 Jan1, 2020. -0.2 Transition impact: Post transition impact: Higher reserves under CECL Compared to the current incurred loss reserve method, CECL at transition date reserve build . Resultado da Windguru weather forecast for United Kingdom - Solent East / Portsmouth . Special wind and weather forecast for windsurfing, kitesurfing and other wind related sports.

{plog:ftitle_list}

webRush e a equipe reabrem o caso de 13 anos de dois imigrantes cambojanos que foram brutalmente assassinados em casa no que se acreditava, na época, ser um assalto. .

The existing supervisory stress test framework generally assumes that the level of the allowance on credit losses at the end of a given quarter equals the amount needed to cover projected loan losses over the next four quarters.

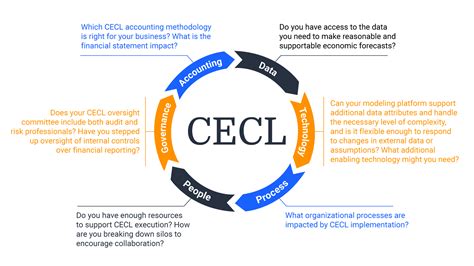

CECL will have an impact on several critical processes including Business-as-usual financial reporting and stress testing. To understand that impact and address it, banks should answer these questions: What will be the . This statement provides additional information on positions that the Federal Reserve plans to take on incorporating the CECL accounting standard into its supervisory .0.8 Jan1, 2020. -0.2 Transition impact: Post transition impact: Higher reserves under CECL Compared to the current incurred loss reserve method, CECL at transition date reserve build .

The objective of this paper is to present an integrated tool suite for IFRS 9- and CECL-compatible estimation in top-down solvency stress tests. The tool suite serves as an .The ASU adds to US GAAP an impairment model known as the current expected credit loss (CECL) model, which is based on expected losses rather than incurred losses. The objectives of the CECL model are to: Reduce the complexity in .Expanding Sensitivity Analysis and Stress Testing for CECL. December 2016. Today’s Speakers. Michael L. Gullette, Vice President, Accounting and Financial Management , American . On the other hand, more recent accounting standards, such as the Financial Accounting Standard Board’s (FASB) Current Expected Credit Losses (CECL), expect .

However, there are significant differences in the underlying purpose and requirements of stress testing compared to those applicable to estimating expected credit losses under CECL. No. At the time of adoption, the actual impact of CECL on an institution's allowance levels will depend on many factors. . forecast period for estimating credit losses under CECL solely because a nine-quarter horizon is . Both the incurred loss model and CECL are subject to GAAP standards making it essential to delineate between scenarios (stress testing – what could happen and trying to quantify the impact of what that means) and forecasts (CECL – expectation for what we think will happen). Stress testing is still considered a model and needs to go through .

Introduction The Financial Accounting Standards Board (FASB) announced in 2016 a new accounting standard introducing the current expected credit loss, or CECL, methodology for estimating allowances for credit losses. CECL becomes effective for federally insured credit unions for financial reporting years beginning after December 15, 2022.Capital Planning and Stress Testing (Rule), for credit unions with assets of billion or more as of March 31 of the prior year (covered credit unions). The Rule was . Credit unions must incorporate the ACL/Net Worth impact of CECL adoption in their 2024 Self-Run SST. In accordance with §702.703 of the Rules and Regulations, the It requires consistent reporting for losses across a company so that a partner, like an auditor, can stress test. This includes monitoring and revalidation based on both company-specific and overarching market indicators. CECL Accounting Standard: Not Just for Banks. There’s a misconception that CECL only applies to financial institutions. To test for the impact of CECL on loan growth, we explore variation in the implementation of CECL across banks. CECL applies to all banks, which includes all banks and bank holding companies that file bank regulatory reports. . The effect of CECL on banks subject to the stress tests could go either way since the increase in reserves reduces .

Double check assumptions, focus on stress testing and back testing, while also preparing for regulatory exams. . Qualitative factors (q-factors) are another key assumption that will impact an institution’s CECL estimate outside of the modeling. Typically, q-factors are included after the modeling is complete and the organization adjusts its .

DOI: 10.69554/vwxw7019 Corpus ID: 202602298; Convexity and correlation effects in expected credit loss calculations for IFRS9/CECL and stress testing @article{Chawla2017ConvexityAC, title={Convexity and correlation effects in expected credit loss calculations for IFRS9/CECL and stress testing}, author={Gaurav Chawla and . During our latest CECL Tuesday talk-through we answered submitted questions on CECL validations and stress-testing. This informative article reviews the questions we answered in our session.These firms did not participate in the supervisory stress tests in 2019 and, therefore, are subject to the supervisory stress tests in 2020. 7 Additionally, these firms are no longer required to conduct company-run stress tests. 8; AOCI opt-out's impact upon stress testing: Under the tailoring rule, an institution that meets the definition of a .

what is cecl

To best capture the effects of CECL on regulatory capital, it would be necessary for a banking organization to calculate the effect on retained earnings of measuring credit loss allowances using both the incurred loss methodology and CECL. . Under the Board's December 2018 amendments to its stress test rules, a banking organization that had .Overview: The Financial Accounting Standards Board (FASB) introduced the new Current Expected Credit Loss (CECL) standard in 2016, and firms subjected to the stress test have adopted it, both in their business-as-usual practice as well as for their internal stress tests. In addition, the Federal Reserve previously announced that it is .

Additionally, management should consider sensitivity or stress testing of the model, including analysis of various scenarios or assumptions and their impact on loss estimates. Add CECL to the 2023 Internal Audit Plan The CECL model, like the historic incurred loss model, should be subject to the bank’s internal audit plan.

• Mandates annual stress testing under a set of supervisory scenarios provided by the FRB, including the . Citi has elected to apply the modified transition provision related to the impact of the CECL methodology on regulatory capital, as provided by the U.S. banking agencies’ September 2020 final rule. For Another commenter warned that (print page 34929) incorporating CECL into the stress testing regimen will increase capital volatility within the modelling and complicate stress testing estimations. The commenter urged the NCUA to continue discussions with covered FICUs and state regulators to ensure the regulatory stress testing framework can .The impact of FASB's CECL standards is significant. While there is much variation across reporting banks, initial filers have reported higher loss reserve levels. And given that increased credit loss provisions represent the largest .

Presidential politics, policy decisions and their economic impact The anticipation of the upcoming election is on the top of everyone’s minds. Join us for an extensive session where Moody's Chief Economist Mark Zandi and .1 2023 Supervisory Stress Tests Credit Union Self-Run Supervisory Stress Testing. Table of Contents . Credit unions should incorporate the ACL/Net Worth impact of CECL adoption in their 2023 Self-Run Stress tests beginning in the quarter of adoption which would be Q1 2023. In accordance with §702.703 of the Rules and Regulations,Review (CCAR) stress test calculation that includes CECL will, in effect, combine the capital impact of CCAR and adoption. CECL could be included in the 2020 stress test due just months after CECL adoption. The stress test capital regime for those institutions between 0 billion and 0 billion will depend on final regulatory rulemaking but .

CECL Methodology Implications for 2020 and 2023 Adopters; Credit Loss Modeling Services: COVID qualitative adjustments, Stress Testing, and CECL; Bridging the Gap: How to Get Started with CECL with No Meaningful Losses; CECL Tips for Financial Institutions Complying in 2023; Large SEC Filers Begin Reporting CECL’s ImpactThe ideal candidate will manage policies, processes, and technology solutions related to CECL and loan stress testing models, ensuring compliance with accounting standards and regulatory requirements while providing strategic insights to support the Company's financial health. . Conduct scenario analysis to estimate the effects of changes in . Since the crisis, stress testing has been a central driver of enhanced global standards for advanced risk management. The use of scenario-based modelling that began with estimations of credit losses and interest rate risk capital levels under defined macroeconomic deterioration has now shifted toward pre-provision net revenue modelling (PPNR). Parallel runs and stress-testing: The process of testing the model in order to weed out potential issues and errors ; . Qualitative factors are another key assumption that will impact an institution’s CECL estimate outside of the modeling. Typically, qualitative factors are included after the modeling is complete and the organization .

the impact of the COVID-19 pandemic, but do include the impact of the Current Expected Credit Losses (CECL) accounting change (see page 5, footnote 3). . • Mandates annual stress testing under a set of supervisory scenarios provided by the FRB, including the Supervisory Severely Adverse Scenario (see next page).

expected credit loss cecl

deloitte performance testing white papers

After going live, banks can look at strategically integrating CECL processes with similar regulatory assessments including comprehensive capital analysis and review (CCAR), Dodd-Frank annual stress testing (DFAST) and Basel risk-weighted assets (RWA). This will create synergies in data procurement, model review, and reconciliation. Figure 4.

Get ahead of the regulators: validate your CECL and capital stress testing models now to ensure compliance, reduce risk, and improve your institution’s business results. . Given the reliance on its output and the related impact to financial reporting, an institution’s CECL model will likely be rated high in the MRM framework, requiring . Stress Test Disclosure . Fannie Mae discloses the impact of the Severely Adverse scenario in two ways: without the establishment of a valuation allowance (VA) on deferred tax assets (DTA) and with the establishment of a VA in Q1 2021. . (CECL)standard,asdirectedbyFHFA. Fannie Mae is required by FHFA to complete stress .

digital assurance testing white paper

cecl stress test results

webbuild Em manutenção Equipe GpGuia Por favor, retorne em breve!

cecl impact on stress testing|what is cecl